🔢 Sign up process for Charities

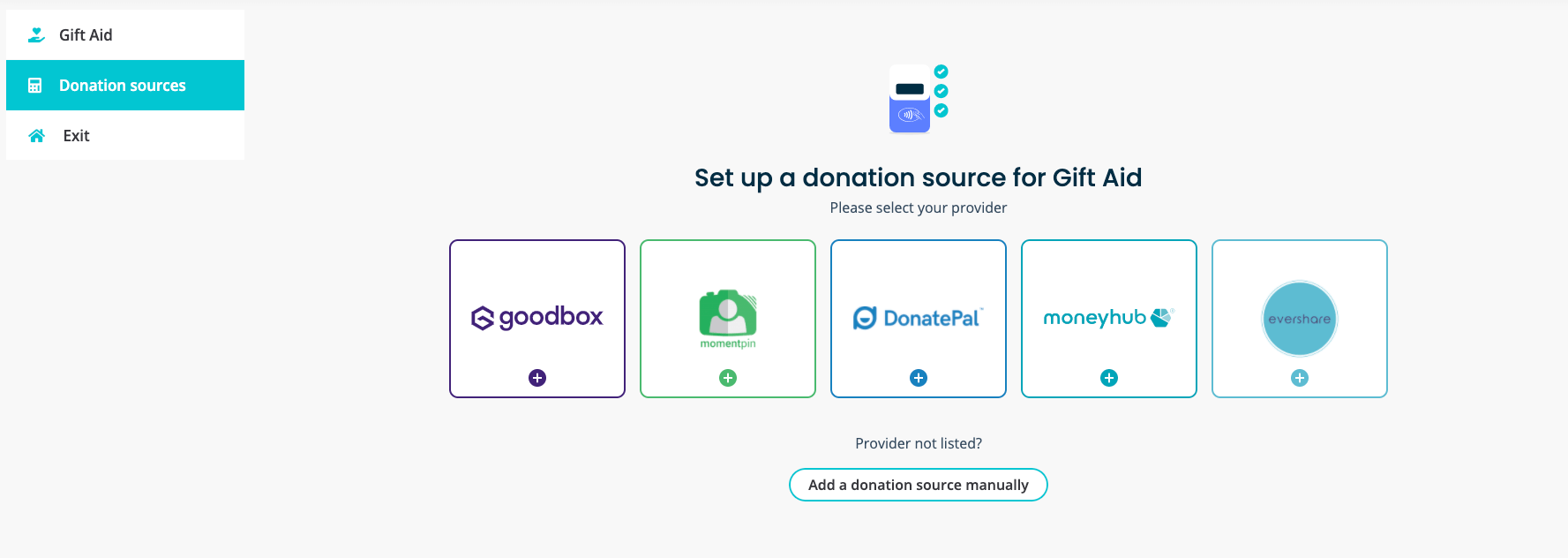

A charity registers and assigns Swiftaid as a charity nominee. The charity then links a donation source by selecting their provider in their Swiftaid account.

Watch a video of the charity registration flow here

Once linked, Swiftaid will be notified every time a donation is made through that source by a donor that has signed up to Swiftaid and Gift Aid will make its way directly from HMRC to the charity automatically.

Swiftaid works as a Gift Aid nominee for UK charities and assigns Gift Aid to the relevant charity every time a qualifying donation is found, managing all records and auditing required by HM Revenue and Customs (HMRC).

Swiftaid…

✅ Matches a donor to their donation

✅ Creates a Gift Aid declaration

✅ Sends a claim to HMRC

✅ Keeps a record of all declarations and claims

✅ GDPR requirements and HMRC auditing

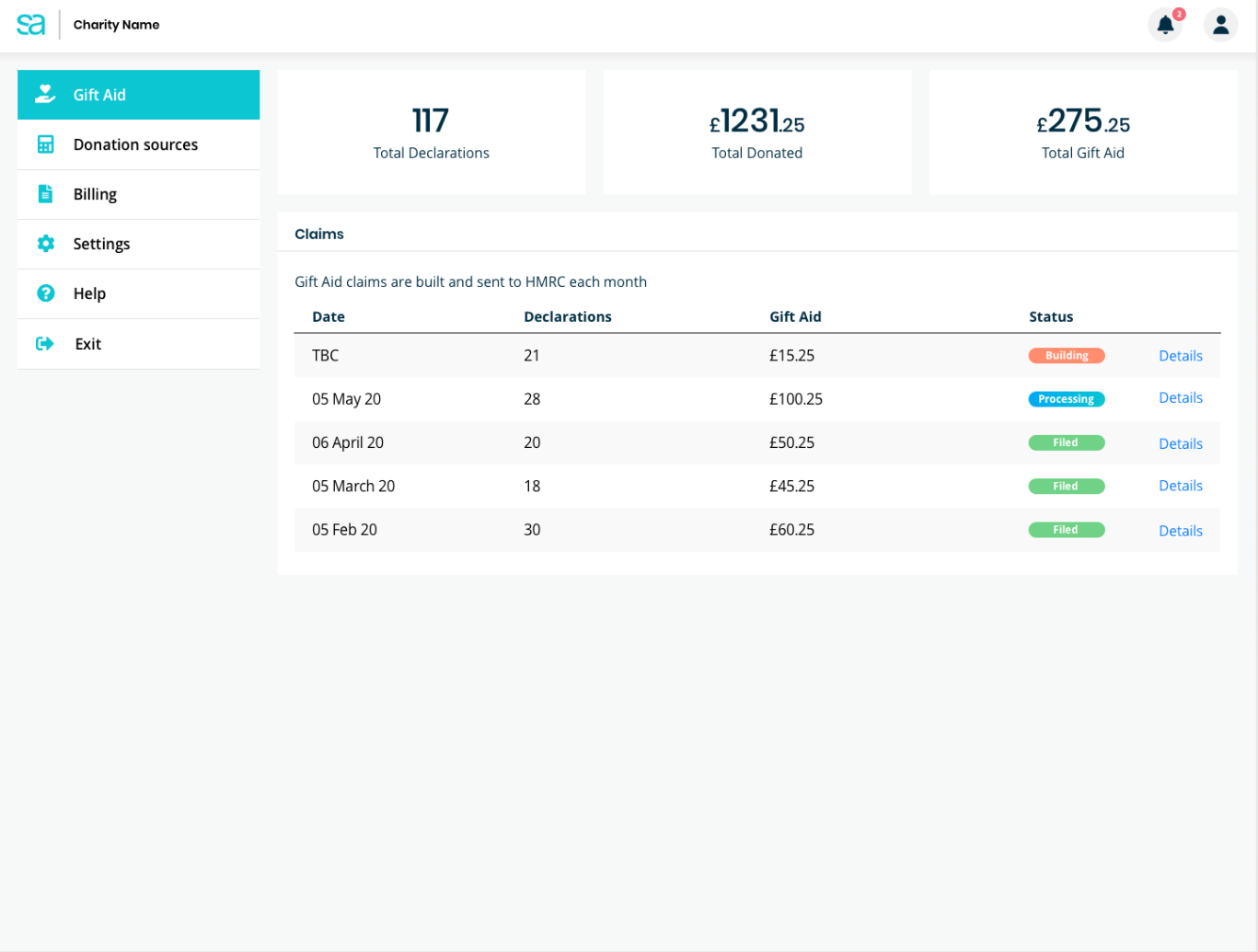

Charities can keep track of all of their Gift Aid claims in their charity dashboard by logging into their Swiftaid account.

🔢 Notifications Swiftaid sends to charities

Nominee assignment letter

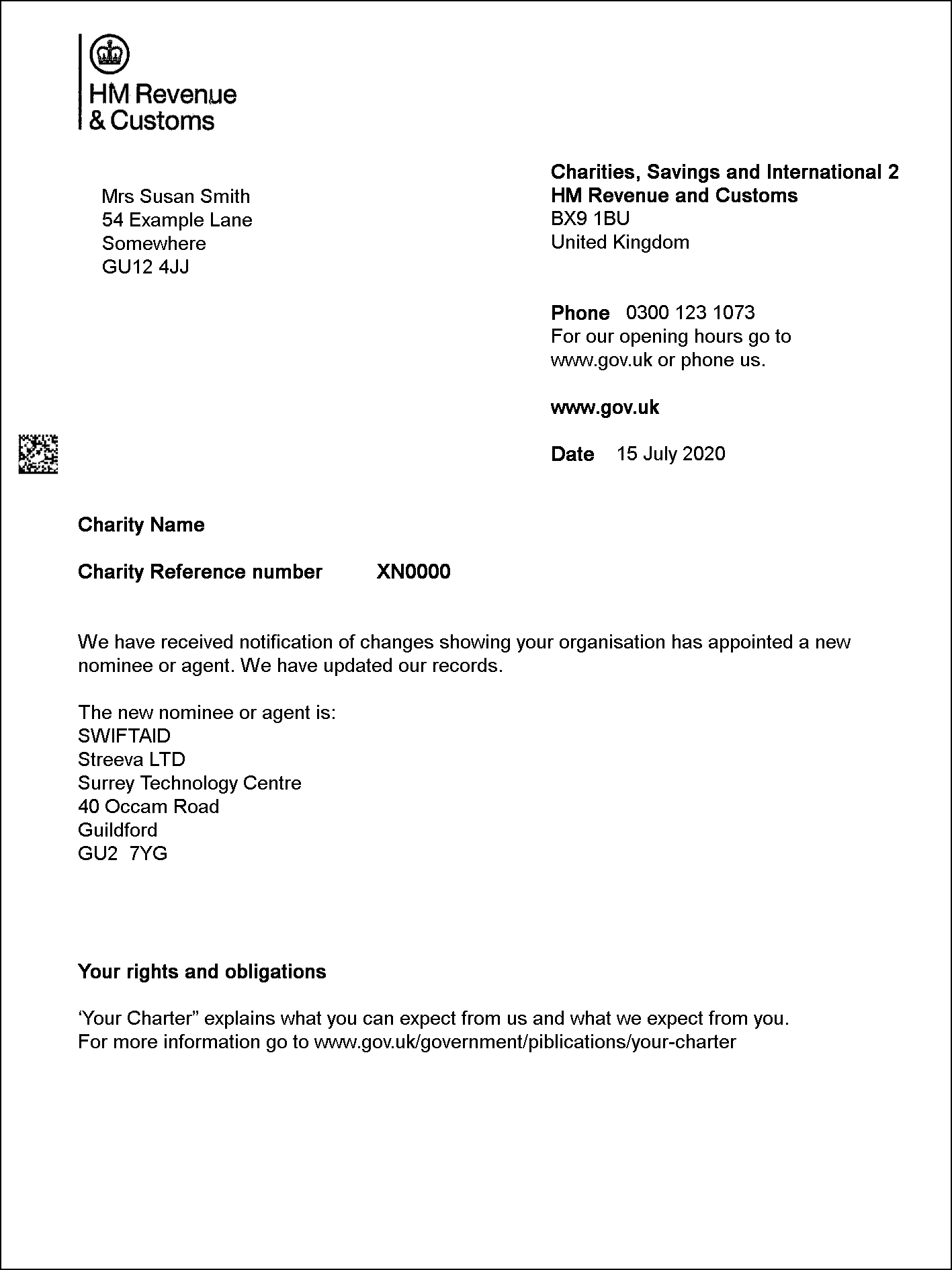

Every charity that assigns Swiftaid as a nominee will receive a letter from HMRC (typically within 4 weeks) confirming the nominee assignment success.