Will donors need to sign up to Swiftaid more than once for different donations?

Donors only need to sign up once and reauthorise once a year to automate Gift Aid declarations on all donations made through any supported platforms and charities.

Swiftaid supports a network of donors, charities and platforms. If a donor joins the network through another charity or platform, Gift Aid will automatically be added to any donations made to your charity.

Each tax year, donors are asked to ensure their details are up to date and reauthorise Swiftaid to create declarations on their behalf. Donors can simply reauthorise Swiftaid when donating through any supported platform or within their Swiftaid account.

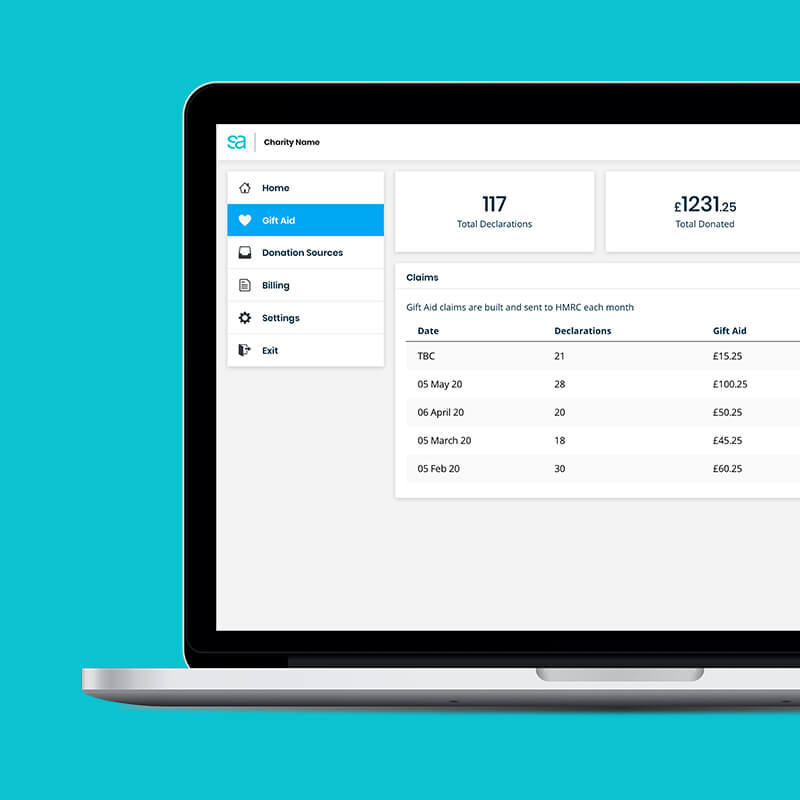

How is Swiftaid funded?

Swiftaid was established with initial funding from an Innovate UK grant and equity investment. Swiftaid provides a number of features for platforms and charities. You can check out the fees on our pricing page.

Donors themselves are not subject to any fees when using Swiftaid.

How does Swiftaid avoid double-claiming?

Swiftaid will only add Gift Aid to donations that the charity has warranted. The charity can inform Swiftaid that it is adding Gift Aid to a donation before submitting a claim to HMRC, to ensure it isn’t claimed twice.

Are donor's Gift Aid declarations shared with charities?

One of Swiftaid’s core values is to respect the privacy and confidentiality of everyone.

Donors authorise Swiftaid as a donor intermediary and their data is only ever used to process Gift Aid. Swiftaid doesn’t share Gift Aid declarations with charities but instead acts as a nominee on their behalf to submit claims directly to HMRC (or provide it to other intermediaries to solely use for the purpose of processing Gift Aid).

Removing the need to share the data with charities keeps them outside GDPR requirements, allowing even the smallest charity to benefit from the Gift Aid network.